Top 10 Biotech Companies in Australia to Watch Leading Into 2026

A practical watchlist of Australia-headquartered biotechs with meaningful momentum across therapeutics, platforms, and next-generation modalities as the industry heads into 2026.

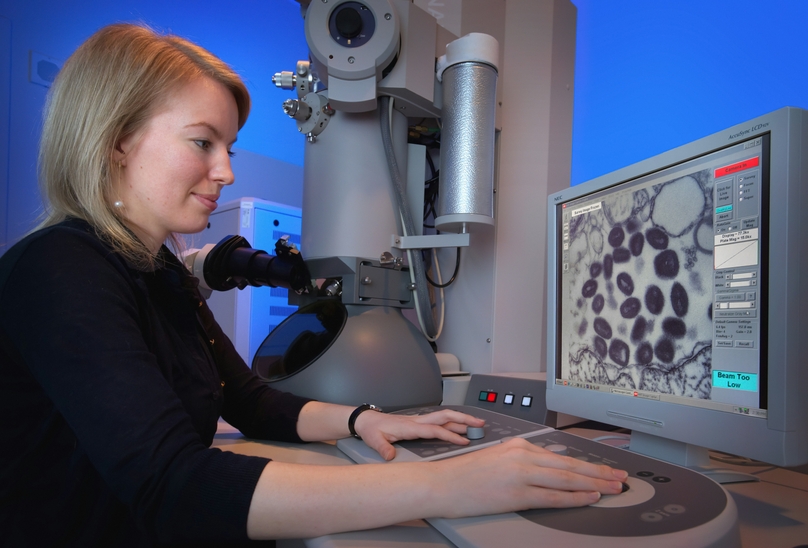

Why Australia’s biotech ecosystem matters in 2026

Australia continues to punch above its weight in biotechnology: world-class translational research, strong clinical infrastructure, and a steady pipeline of ASX-listed innovators spanning cell therapy, radiopharmaceuticals, dermatology, oncology, and infectious disease. As global biopharma tightens focus on execution and capital efficiency, Australia’s next wave of biotechs stands out for lean operating models and clear clinical pathways.

What this list is (and isn’t): This is a curated set of Australia-headquartered biotech companies worth tracking leading into 2026. It’s not a ranking of “best” companies—rather, a watchlist built around visible momentum and relevance to modern biopharma trends.

How we selected the top 10

- Headquartered in Australia (primary HQ or registered/principal office)

- Clear focus in biotech / biopharma (therapeutics, platforms, or clinical-stage innovation)

- Evidence of momentum: clinical progression, commercial execution, or platform differentiation

- Representative mix across modalities (radiopharma, cell therapy, oncology, infectious disease, specialty pharma)

Top 10 biotech companies in Australia to watch leading into 2026

Format per company: Website, Founded, Size, and a short profile on why it’s worth watching.

1) CSL

Website: csl.com

Founded: 1916

Size: 32,000+ employees

CSL remains Australia’s anchor biotech—one of the few globally scaled leaders spanning plasma-derived therapies, vaccines, and specialty biopharma. Heading into 2026, CSL’s influence is less about “emerging biotech” and more about how it continues to invest, expand, and set a global execution benchmark from an Australia-based footprint.

2) Telix Pharmaceuticals

Website: telixpharma.com

Founded: 2015

Size: ~200+

Telix is a leading example of Australia-origin radiopharma scaling into global commercial execution. With a growing footprint and an oncology-focused pipeline, Telix is worth watching not just for product progress but for how it operationalizes theranostics at scale.

3) Mesoblast

Website: mesoblast.com

Founded: 2004

Size: ~80 employees

Mesoblast is one of Australia’s most visible regenerative medicine names. Its longevity reflects both the promise and difficulty of scaling cell therapy programs. Going into 2026, Mesoblast remains a company to track for clinical and regulatory inflection points and broader sentiment around cell-based medicines.

4) Clinuvel Pharmaceuticals

Website: clinuvel.com

Founded: 2001

Size: 11–50 employees

Clinuvel stands out as a specialty biopharma with a commercial foundation and a focused approach to photomedicine and rare disease. It’s one to watch for how it expands indications and sustains durable growth while staying strategically narrow.

5) Starpharma

Website: starpharma.com

Founded: 1996

Size: 11–50 employees

Starpharma is known for its dendrimer technology, positioned at the intersection of novel delivery, platform science, and therapeutics. Heading into 2026, the company remains notable as a platform-based biotech with a differentiated technical foundation.

6) Imugene

Website: imugene.com

Founded: 2012

Size: 11–50 employees

Imugene is an Australia-headquartered immuno-oncology-focused biotech. It’s worth watching as a representative of ASX clinical-stage oncology development—where progress is often defined by partnerships, trial readouts, and capital-efficient program focus.

7) Recce Pharmaceuticals

Website: recce.com.au

Founded: 2007

Size: 11–50 employees

Recce is focused on anti-infectives—an area of renewed urgency globally as resistance rises and the pipeline remains constrained. It’s a company to track for clinical progress and for how antimicrobial development models evolve heading into 2026.

8) Noxopharm

Website: noxopharm.com

Founded: 2015

Size: 11–50 employees

Noxopharm is a clinical-stage biotech with programs spanning oncology and immunology-related areas. It’s worth monitoring as part of the broader wave of smaller, focused clinical-stage companies that aim to produce clear milestones with lean teams.

9) Botanix Pharmaceuticals

Website: botanixpharma.com

Founded: 1984

Size: ~10–11 employees

Botanix is a compact clinical-stage company with a dermatology and anti-infective angle. It’s a reminder that “biotech scale” can look very different in Australia—where smaller teams often pursue targeted programs with clear commercial endpoints.

10) Race Oncology (now Racura Oncology)

Website: racuraoncology.com

Founded: 2011

Size: ~10-11 employees

Race (Racura) is a clinical-stage oncology-focused company that remains closely followed in Australia’s biotech markets. It’s one to watch for how focused oncology programs manage clinical progress, financing cycles, and investor visibility heading into 2026.

What these companies signal about Australia’s biotech trajectory

Modality diversity is a strength

From radiopharma (Telix) to regenerative medicine (Mesoblast) to specialty pharma and dermatology (Clinuvel, Botanix), Australia’s pipeline isn’t concentrated in one trend.

Lean teams, milestone-driven models

Many Australia-based biotechs operate with small headcount and clear milestone strategies—an operating style that aligns with 2026’s emphasis on capital efficiency.

Global execution is possible from Australia

CSL (and increasingly Telix) demonstrate that globally relevant biotech execution can be built from an Australia HQ footprint.

Clinical infrastructure remains a tailwind

Australia’s clinical trial ecosystem continues to support early and mid-stage development, helping companies validate programs efficiently before expanding globally.

What 2026 could represent for Australian biotech

Leading into 2026, the key question is less “Does Australia produce biotech?” and more “Which companies translate science into repeatable development and scalable operations?” The biotechs above are worth watching because they sit closer to execution—commercial scale, clinical inflection points, or platform differentiation—rather than purely early discovery narratives.